SSS Appointment

SSS Appointment 2025

The SSS Appointment System is an online platform that lets members book specific dates and times for branch visits. Designed to reduce overcrowding and improve efficiency, it covers transactions like:

- Loan applications (salary, calamity, housing).

- Benefit claims (maternity, sickness, retirement).

- Membership updates (e.g., correcting personal details).

Key Benefits:

Saves time: Skip walk-in lines.

Organized visits: Pre-select your transaction type.

Safety: Minimize physical contact (ideal for post-pandemic needs).

2. Step-by-Step Guide to Scheduling an Set Appointment SSS

Subheading: How to Book Your SSS Appointment in 5 Easy Steps

Step 1: Visit the Official SSS Website

Go to www.sss.gov.ph and click “Appointment System” under the Member Services tab.

Step 2: Log In or Register

- Existing users: Enter your SSS username and password.

- New users: Register using your SSS number, email, and mobile number.

Step 3: Navigate to the Appointment Section

Select “Schedule Appointment” and choose your preferred branch.

Step 4: Pick a Date, Time, and Transaction

- Popular branches (e.g., Quezon City, Manila) fill up fast—book 1-2 weeks ahead.

- Double-check your transaction type (e.g., Salary Loan vs. Retirement Claim).

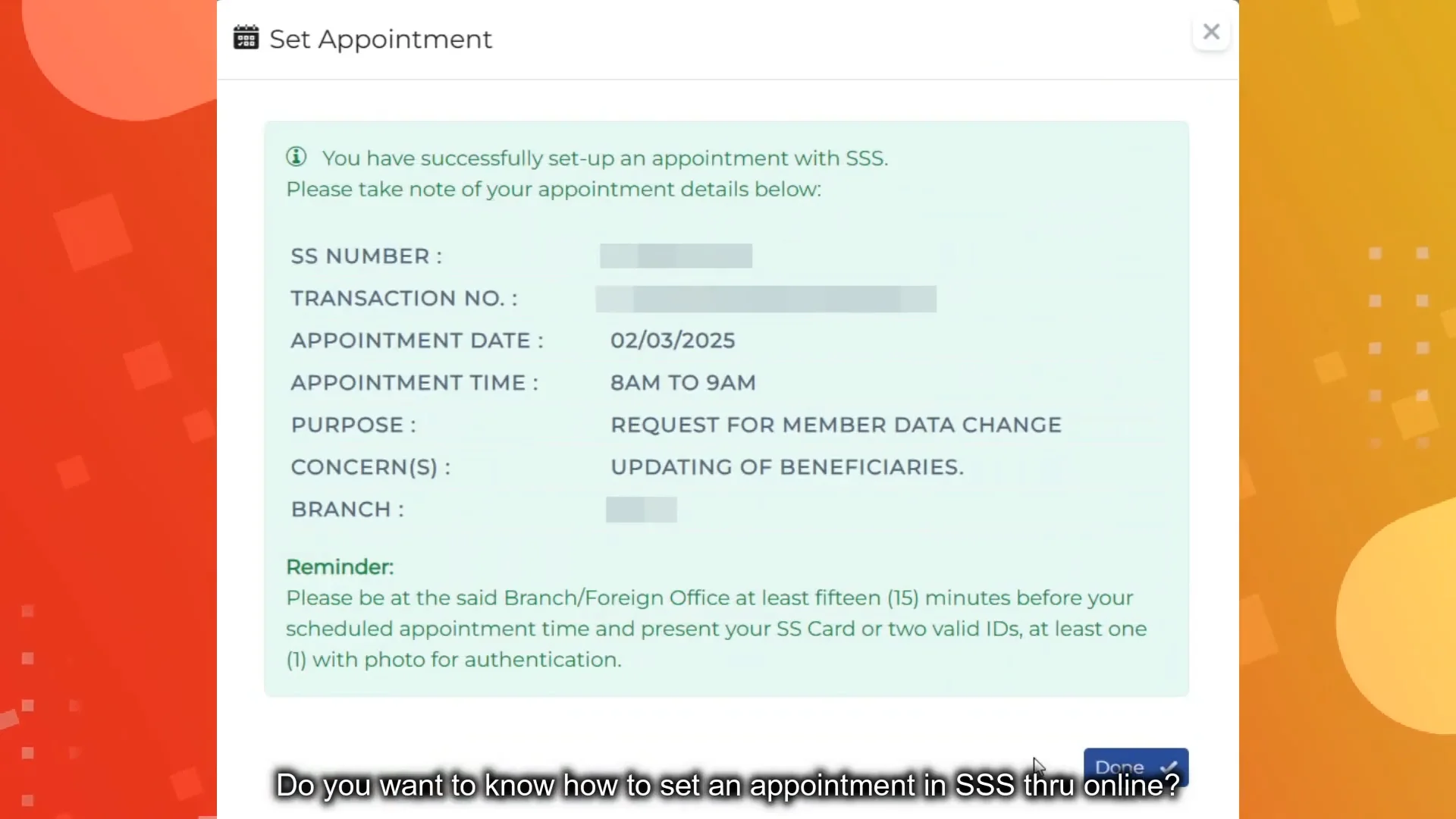

Step 5: Confirm and Save Your Reference Code

Print or screenshot the confirmation page. You’ll need this for your branch visit!

| Mistake | Solution |

|---|---|

| Double booking | Wait for email/SMS confirmation before reattempting. |

| Wrong branch selected | Cancel and reschedule at least 24 hours prior. |

| Missing documents | Review SSS requirements here. |

3. SSS Online vs. In-Person: Which is Better?

Subheading: Traditional vs. Digital SSS Transactions

| Feature | Online Appointment | Walk-In |

|---|---|---|

| Wait Time | 10-30 minutes | 1-3 hours |

| Availability | 24/7 booking | Branch hours only |

| Convenience | Schedule from home | Immediate but unpredictable |

| Technical Requirements | Internet + device | None |

Verdict: The appointment SSS system wins for planned transactions, while walk-ins suit urgent, simple requests.

4. How the SSS Contribution Calculator Elevates Your Planning

Subheading: Maximize Benefits with ssscontributioncalculator.online

This free tool helps you:

- Estimate monthly contributions: Based on your salary range.

- Project future pensions: See how increased payments boost retirement funds.

- Check loan eligibility: Determine how much you can borrow.

Table 3: SSS Contribution Tiers (2023)

| Monthly Salary | Employee Share | Employer Share | Total |

|---|---|---|---|

| PHP 10,000 | PHP 400 | PHP 800 | PHP 1,200 |

| PHP 20,000 | PHP 800 | PHP 1,600 | PHP 2,400 |

| PHP 30,000 | PHP 1,200 | PHP 2,400 | PHP 3,600 |

- PHP 1,200/month contributions: ~PHP 12,000/month pension after 20 years.

- PHP 3,600/month contributions: ~PHP 25,000/month pension.

Why It Matters: Higher contributions = bigger loans and pensions. Use the calculator to strategize.

5. Pros and Cons of the SSS Appointment System

Subheading: Is the SSS Online Booking Worth It?

| Pros | Cons |

|---|---|

| Saves hours of waiting | Requires stable internet |

| Reduces branch crowding | Limited slots in metro areas |

| Real-time SMS/email updates | Occasional website downtime |

Tip: Book appointments at less busy branches (e.g., provincial SSS offices) for faster slots.

6. Frequently Asked Questions (FAQs)

Subheading: Your Top SSS Appointment Queries Answered

Q1: Can I reschedule my appointment SSS?

Yes! Log into your SSS account, cancel the existing slot, and book a new one.

Q2: What if I forget my reference code?

Check your email or SSS portal under “Appointment History.”

Q3: Are walk-ins still allowed?

Yes, but priority goes to those with appointments.

Q4: How do I compute my SSS contributions?

Use the free SSS Contribution Calculator for instant results.

Conclusion

Mastering the appointment SSS system is essential for every Filipino worker. By booking online, you save time, avoid stress, and gain control over your SSS transactions. Pair this with the SSS Contribution Calculator to optimize your payments and unlock bigger benefits.