SSS Contribution Table for Household Employers and Kasambahays in 2025

Are you a household employer or kasambahay in the Philippines? Understanding the updated SSS Contribution Table for 2025 is crucial to ensure compliance and secure benefits for your household workers. This guide will walk you through everything you need to know about the new contribution rates, how to calculate them, and why they matter. Whether you’re a first-time employer or a seasoned one, this step-by-step guide will help you navigate the process with ease.

What is the SSS Contribution Table for Household Employers and Kasambahays?

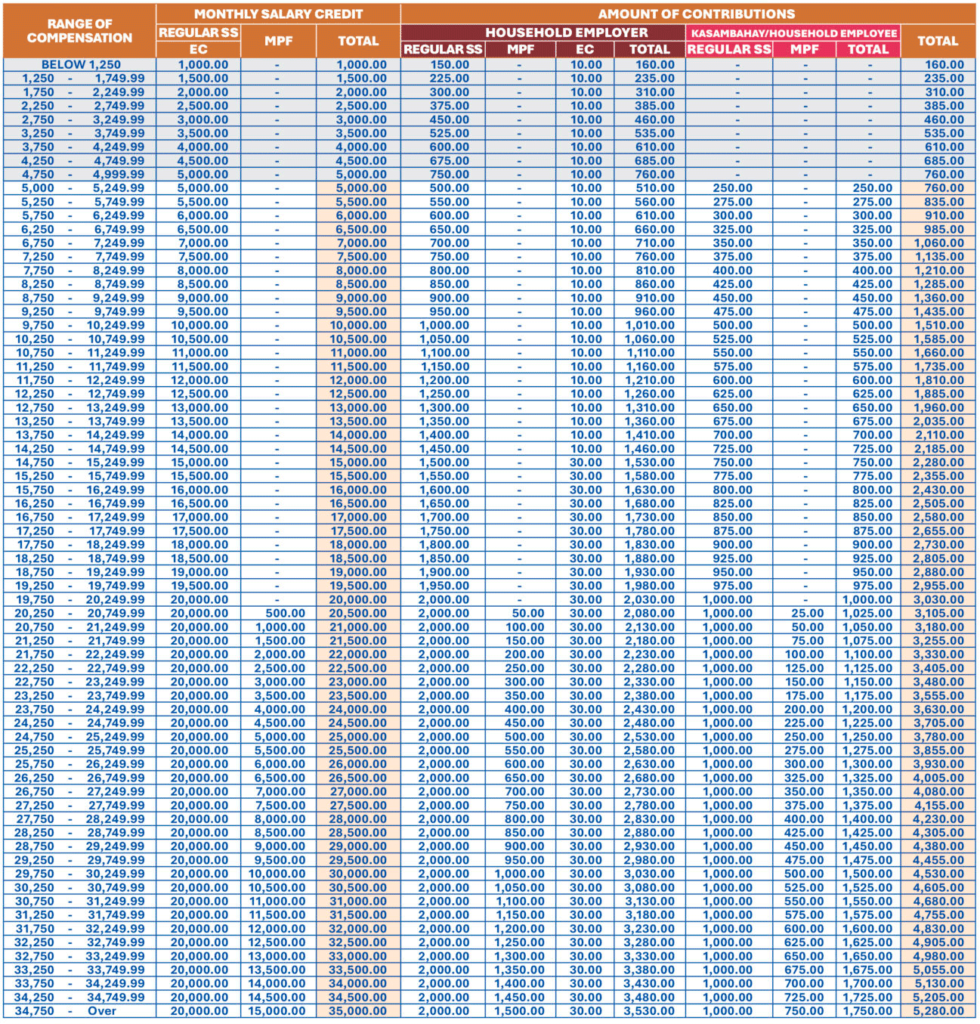

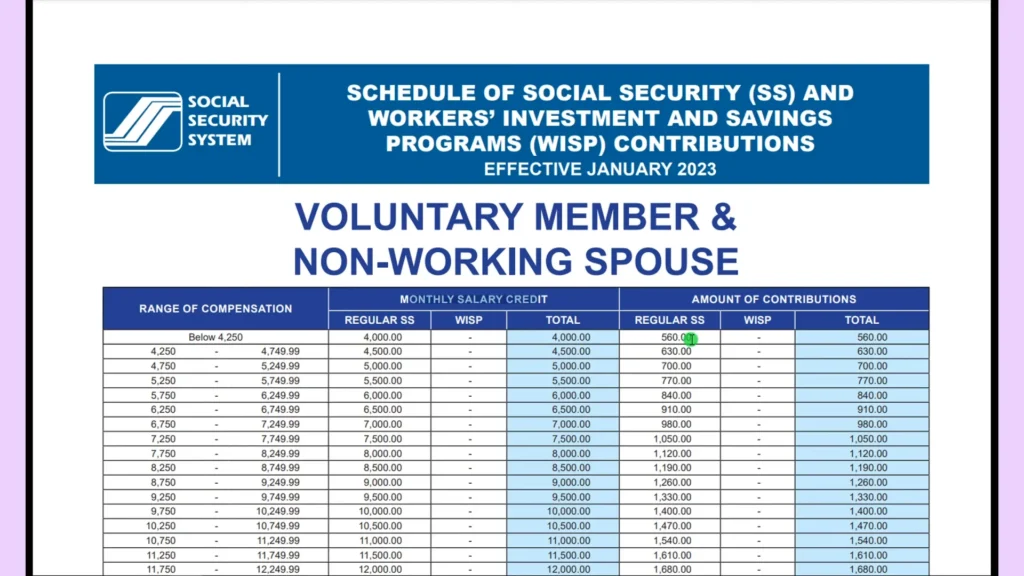

The SSS Contribution Table is a detailed breakdown of the monthly contributions that household employers and kasambahays (domestic workers) must pay to the Social Security System (SSS). These contributions ensure that kasambahays are covered under the SSS, providing them with benefits like sickness, maternity, disability, and retirement support. For household employers, complying with these contributions is not just a legal obligation but also a way to support their workers’ financial security.

The 2025 updates to the contribution table reflect changes in salary brackets and contribution rates, making it essential for employers to stay informed. By understanding the table, you can ensure accurate payments and avoid penalties while securing your kasambahay’s future.

Step-by-Step Guide to the 2025 SSS Contribution Table

Step 1: Determine the Monthly Salary Credit (MSC)

The Monthly Salary Credit (MSC) is the basis for calculating SSS contributions. It corresponds to the kasambahay’s monthly salary, which falls within specific ranges set by the SSS. For example, if your kasambahay earns ₱5,000 monthly, their MSC will fall under the ₱5,000–₱5,499 bracket.

Here’s a simplified 2025 MSC Table for reference:

| Monthly Salary Range | Monthly Salary Credit (MSC) |

|---|---|

| ₱5,000 – ₱5,499 | ₱5,000 |

| ₱5,500 – ₱5,999 | ₱5,500 |

| ₱6,000 – ₱6,499 | ₱6,000 |

| … | … |

| ₱25,000 and above | ₱25,000 |

Step 2: Calculate Employer and Employee Shares

Both the household employer and the kasambahay share the responsibility of paying SSS contributions. The employer covers the majority, while the kasambahay pays a smaller percentage. For 2025, the contribution rate is 14% of the MSC, with the employer paying 10% and the kasambahay paying 4%.

Example Calculation:

If the MSC is ₱5,000:

- Total Contribution: 14% of ₱5,000 = ₱700

- Employer Share: 10% of ₱5,000 = ₱500

- Kasambahay Share: 4% of ₱5,000 = ₱200

Step 3: Understand the Maximum and Minimum Contributions

The SSS sets minimum and maximum contribution limits based on salary brackets. For 2025, the minimum MSC is ₱5,000, and the maximum is ₱25,000. This means contributions are capped even if the kasambahay earns more than ₱25,000.

Step 4: Payment Process and Deadlines

To remit contributions, household employers can use the SSS online portal or visit an SSS branch. Payments are due monthly, and late payments may incur penalties. Keeping track of deadlines ensures compliance and avoids unnecessary fees.

Table: 2025 SSS Contribution Table for Kasambahays

| Monthly Salary Range | MSC | Total Contribution (14%) | Employer Share (10%) | Kasambahay Share (4%) |

|---|---|---|---|---|

| ₱5,000 – ₱5,499 | ₱5,000 | ₱700 | ₱500 | ₱200 |

| ₱5,500 – ₱5,999 | ₱5,500 | ₱770 | ₱550 | ₱220 |

| ₱6,000 – ₱6,499 | ₱6,000 | ₱840 | ₱600 | ₱240 |

| … | … | … | … | … |

| ₱25,000 and above | ₱25,000 | ₱3,500 | ₱2,500 | ₱1,000 |

Pros and Cons of the 2025 SSS Contribution Scheme

Pros

- Enhanced Benefits for Kasambahays: Access to sickness, maternity, disability, and retirement benefits.

- Legal Compliance: Avoid penalties and legal issues by adhering to the updated rates.

- Financial Security: Ensure your kasambahay’s future is protected through social security coverage.

Cons

- Increased Financial Burden: Higher contribution rates may strain household employers’ budgets.

- Complex Calculations: Small-scale employers may find the process time-consuming.

- Penalties for Non-Compliance: Late or missed payments can result in fines.

Tips for Household Employers to Ensure Compliance

- Use the SSS Online Calculator: Simplify contribution calculations with the official SSS tool.

- Keep Records: Maintain accurate records of payments and MSC ranges for future reference.

- Educate Your Kasambahay: Explain the benefits of SSS contributions to encourage cooperation.

- Stay Updated: Regularly check the SSS website for announcements or changes in rates.

Frequently Asked Questions (FAQs)

1. What happens if I miss a contribution payment?

Late payments may result in penalties, and your kasambahay’s benefits could be affected. It’s best to remit contributions on time.

2. Can kasambahays avail of loans through SSS?

Yes, kasambahays with active contributions can apply for SSS salary loans, calamity loans, and other benefits.

3. How does the 2025 contribution table differ from previous years?

The 2025 table reflects updated MSC ranges and contribution rates, ensuring higher benefits for kasambahays.

4. Are there penalties for underreporting salaries?

Yes, underreporting salaries to reduce contributions is illegal and can result in fines or legal action.

Conclusion

Understanding the 2025 SSS Contribution Table is essential for household employers and kasambahays alike. By following this guide, you can ensure accurate calculations, timely payments, and compliance with Philippine labor laws. Remember, securing your kasambahay’s future through SSS contributions is not just a legal obligation—it’s a step toward building a more secure and supportive household environment.

Start complying with the 2025 SSS Contribution Table today and ensure your kasambahay’s future is protected.